Europe’s electric vehicle (EV) market is undergoing a major transformation. While overall EV sales remain strong up 23% year-over-year with 361,000 units sold in June 2025 the landscape is shifting rapidly. Tesla, once the undisputed leader, is now facing mounting competition from legacy automakers, emerging Chinese brands, and a surprising surge in plug-in hybrid electric vehicles (PHEVs).

For years, battery-electric vehicles (BEVs) dominated the conversation. But recent data suggests consumer preferences are evolving. In June, BEV sales grew 16% year-over-year, while PHEV sales soared by 40%. The growth is being powered by accessible plug-in hybrids that serve as a practical bridge for those not quite ready to go all-electric.

At the forefront of this trend is the BYD Seal U, a midsize SUV gaining rapid popularity for its plug-in hybrid version. Priced under €40,000, it undercuts many gasoline competitors while offering 217 horsepower and 80 km of electric-only range. That makes it ideal for daily commutes without tapping into the fuel tank. Volkswagen is also making waves with its new Tiguan PHEV, delivering over 100 km of electric-only range and offering DC fast charging—a rare feature in the plug-in hybrid category.

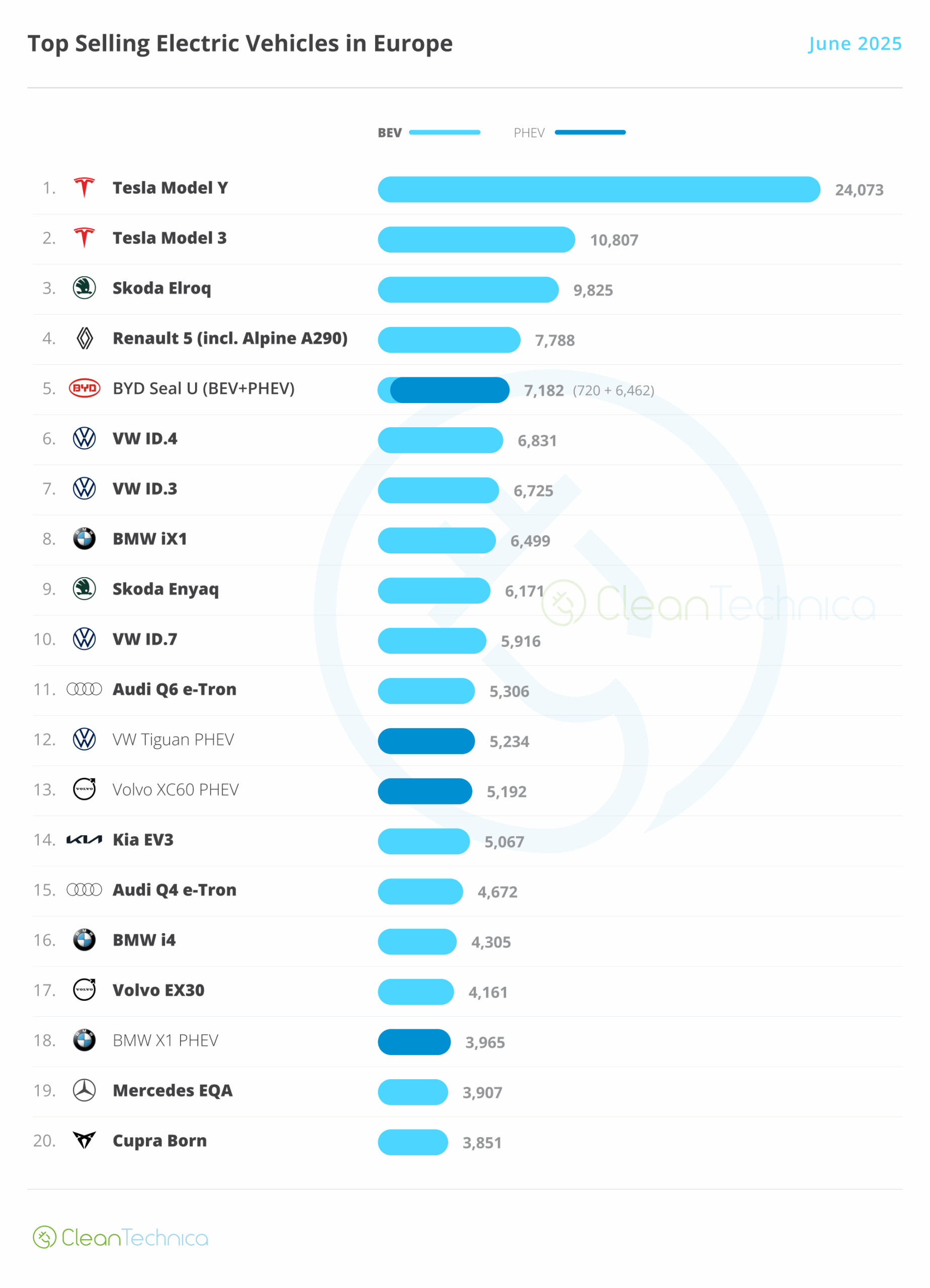

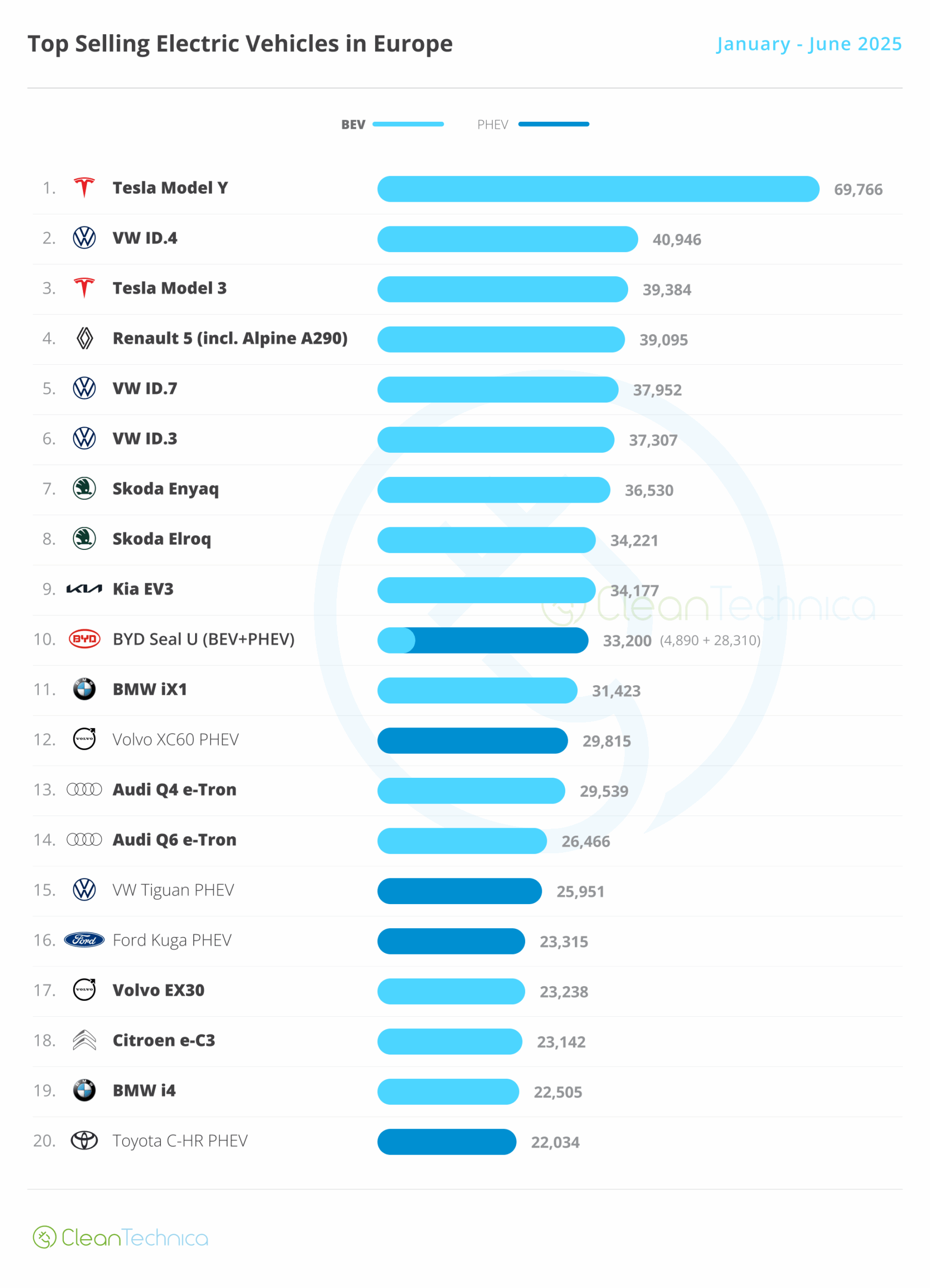

Meanwhile, Tesla finds itself in a more precarious position. The Model Y continues to lead the European market, topping June’s charts with 24,073 registrations. However, its sibling, the Model 3, is struggling. Sales of the electric sedan dropped a steep 48% compared to the same month last year, totaling just 10,807 units. With price cuts and marketing efforts seemingly focused on the German-made Model Y, the Model 3 appears to be losing relevance in a market that’s quickly expanding and diversifying.

As Tesla’s dominance fades, European automakers are rising to the occasion. With a starting price of €34,000, the Skoda Elroq is making a strong debut in the compact EV segment. With 9,825 registrations in June, it offers a more affordable alternative to the Enyaq without sacrificing appeal. Its success also proves that mainstream brands can introduce new EVs without cannibalizing their existing lineup. Renault is also gaining momentum with the retro-styled Renault 5 and its sportier cousin, the Alpine A290, which together sold 7,788 units in June.

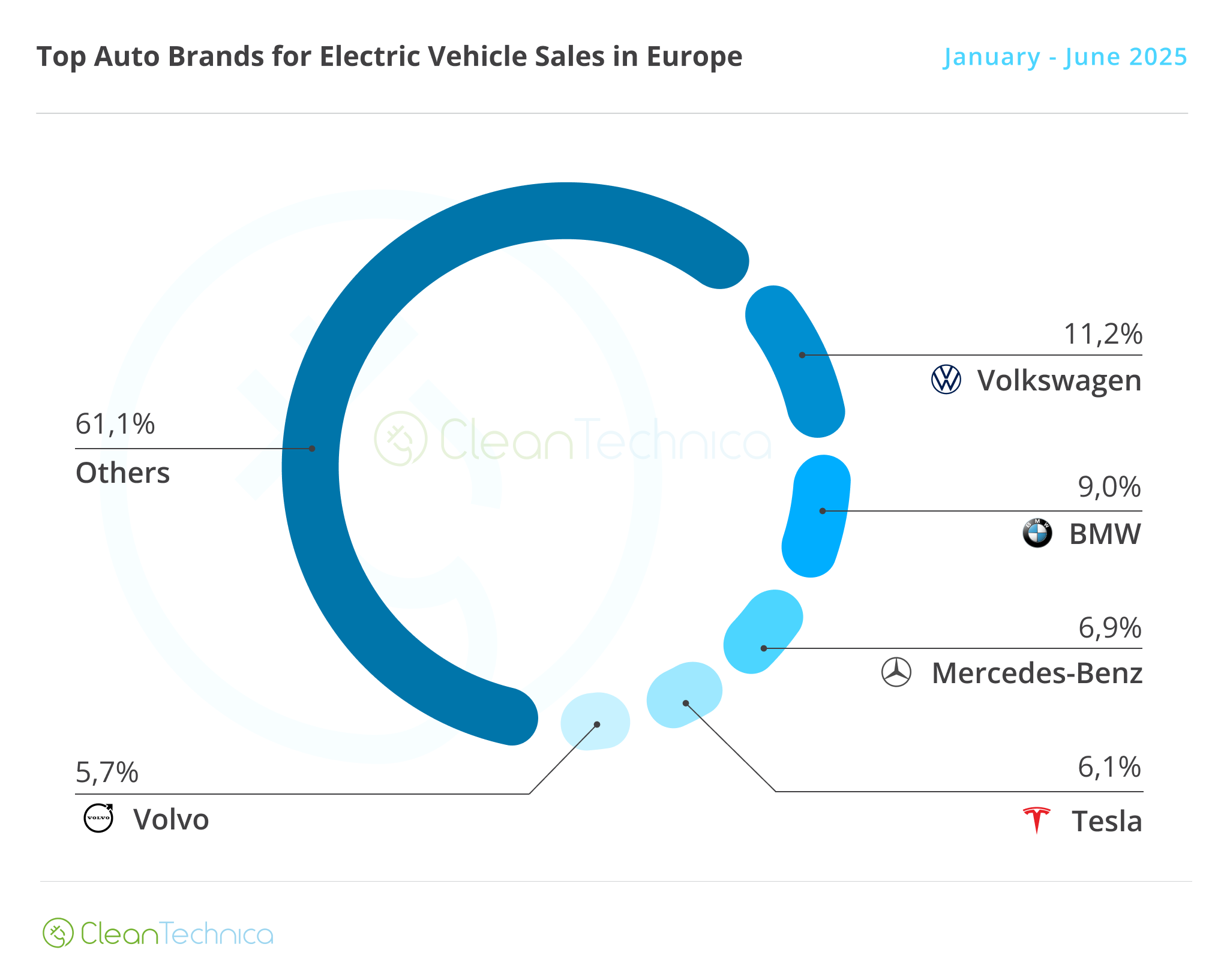

Tesla’s decline has reshuffled the leaderboard. After three years at the top, Tesla has dropped to fourth place among Europe’s top EV brands, now holding just a 6.1% market share. Volkswagen has taken the crown with 11.2%, followed by BMW and Mercedes-Benz in second and third place, respectively. Skoda has climbed to the seventh spot another sign that electric vehicles are no longer just for early adopters or premium buyers. Meanwhile, Chinese giant BYD is rapidly gaining ground, now holding 4.1% of the market.

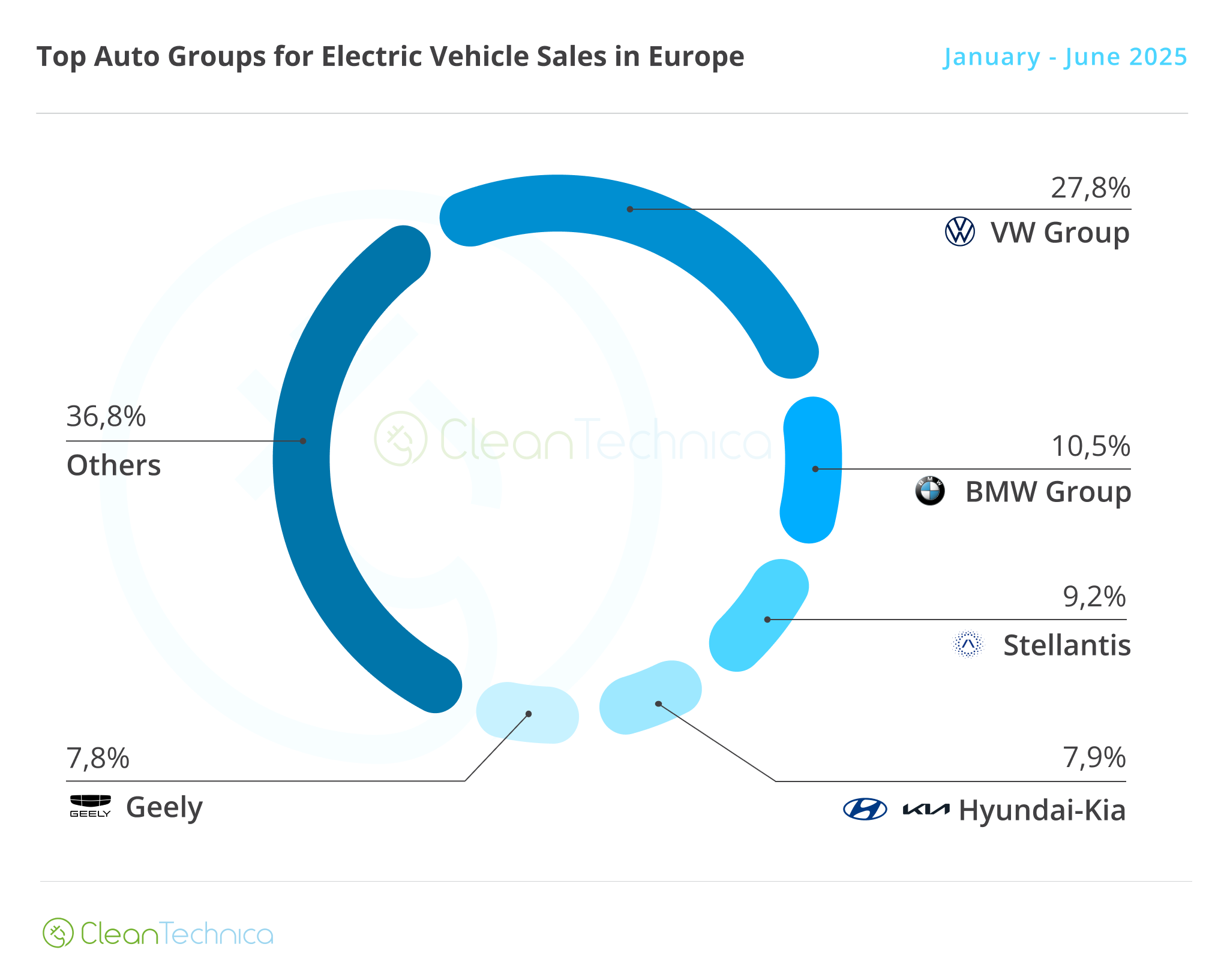

Looking at the broader industry picture, the Volkswagen Group remains the dominant force in Europe’s plug-in vehicle market. With a commanding 27.8% share, it sits well ahead of the BMW Group, which maintains a solid second-place position. Stellantis, on the other hand, continues to trail behind in the electrification race.

In addition to shifting market share, the data highlights another encouraging trend: segment diversification. Volkswagen’s ID.Buzz is revitalizing the multi-purpose vehicle space, proving there’s strong demand for practical electric transport. Sales in the MPV segment have nearly doubled this year, proving that demand is growing beyond the traditionally dominant crossover class. This broadening of vehicle types reflects a more mature EV market one that caters to a wider variety of needs, from families to business users.

As competition heats up and consumer demands evolve, the European EV market is clearly entering a new phase one where variety, value, and versatility matter just as much as brand legacy or early-mover advantage.

What are your thoughts on Volkswagen’s lead in Europe’s EV market and the growing popularity of niche segments like MPVs? Do you see this diversification as a sign of a more mature EV ecosystem? Let us know in the comments below.